Best AI Finance Tools 2025: Looking for the best AI finance tools in 2025?

Welcome to the future of smart money management — where Artificial Intelligence isn’t just an assistant; it’s your full-time financial strategist.

The Rise of AI in Personal Finance – Best AI Finance Tools 2025

We’re standing at the crossroads of a financial revolution. Artificial Intelligence (AI) isn’t just tinkering around the edges of our economy anymore—it’s diving straight into the heart of how we manage money. Personal finance in 2025 has taken a sharp turn from passive tracking and manual input to intelligent prediction, behavior-driven insights, and proactive decision-making powered by algorithms that learn from us.

In the past, money management relied heavily on self-discipline, spreadsheets, and occasional financial advisor consultations. Today, AI has stepped in to automate, optimize, and personalize our finances like never before. Imagine having a financial coach that monitors your income, spending habits, savings goals, and investment risks 24/7—and adapts in real time to guide you. That’s the power AI brings to personal finance in 2025.

The evolution began with basic budgeting apps. Now we have full-fledged AI personal finance tools offering automated savings, intelligent expense tracking, real-time investment recommendations, credit score improvement strategies, and even emotional spending alerts. Whether you’re a digital nomad, a small business owner, a freelancer juggling multiple gigs, or just someone trying to stretch your paycheck further, these AI tools are now indispensable.

This blog will break down everything you need to know: from the best AI budgeting tools to investment advisors, from credit health optimizers to retirement planners—all built with artificial intelligence at their core. You’ll also discover how to choose the right tools for your needs, how businesses are scaling faster with AI financial apps, and what the future holds for AI-driven finance.

Get ready to turn your financial life into a well-oiled machine—driven by data, and powered by intelligence.

Why 2025 Is the Year to Switch to AI Tools

Let’s be real—if you’re still doing your budgeting with Excel or manually jotting down your expenses in 2025, you’re already behind.

Why is now the moment to make the switch?

1. Explosion in AI Capabilities

Thanks to massive advances in machine learning, natural language processing, and big data integration, today’s AI finance tools can do more than just analyze spreadsheets. They understand your habits, predict your needs, and evolve with your behavior. They’ve gone from being calculators to advisors.

2. Inflation and Cost of Living

With the post-pandemic world struggling through inflation, rising rent, fuel, and food prices, smart money management is no longer optional. AI-powered tools give you an edge by making precise decisions and finding hidden savings.

3. Multiple Income Streams Are the Norm

Whether it’s gig work, side hustles, affiliate income, or consulting gigs, the traditional paycheck is becoming a thing of the past. AI finance platforms integrate multiple income sources and provide consolidated financial reports that help you stay sane and scale.

4. Digital Banking and Open Finance

The shift toward open banking APIs means that AI tools can access, analyze, and optimize your accounts in real time—across different banks, wallets, and platforms. They automatically track transactions, alert for fraud, and recommend rebalances across savings or investments.

5. Time Is Money

Most people don’t have time to constantly monitor charts, bank statements, or investment portfolios. AI tools work in the background, letting you focus on growth while they handle the grunt work.

2025 isn’t about financial literacy alone—it’s about financial empowerment through automation. You no longer have to be a finance expert to win with money. You just need the right tools—and this year, they’re more powerful and more accessible than ever before.

Benefits of Using AI for Personal Finance

AI isn’t just a buzzword anymore. In 2025, it’s a financial strategy. Personal finance tools powered by AI are redefining how we budget, save, invest, and build long-term wealth. Whether you’re an individual trying to manage your salary, a freelancer handling variable income, or a startup founder juggling cash flow, AI makes the process simpler and more effective.

1. Real-Time Financial Insights

AI tools give you live insights into your financial health. They categorize your expenses automatically, notify you of spending trends, and alert you when you’re nearing your budget limits.

2. Customized Financial Advice

Unlike static spreadsheets or generic tips from blogs, AI tools personalize suggestions based on your financial behavior. If you usually overspend in certain categories, it’ll recommend caps. If you save well in others, it may nudge you to increase your investment contributions.

3. Automatic Savings and Budget Adjustments

Based on your income and expenses, AI can automatically move small amounts into your savings without you lifting a finger. These tools adapt dynamically—so if your income fluctuates or your bills spike, your budget updates itself.

4. Predictive Analytics

One of the most game-changing features is prediction. AI doesn’t just tell you where your money went—it tells you where it’s likely to go. Whether it’s upcoming bills, tax dues, or seasonal spending patterns, AI financial platforms prepare you for what’s ahead. This helps reduce financial anxiety and increase preparedness.

5. Better Investment Decisions

AI investment tools learn your risk tolerance and financial goals. They adjust your portfolio based on market conditions and your personal timeline. Some platforms even integrate news sentiment analysis to pivot investments away from volatility.

6. Improved Credit Management

AI tools like Credit Karma and Experian Boost are integrating deeper intelligence. They give actionable tips to boost your credit score, monitor usage ratios, and simulate how changes (like paying off a card) will impact your score.

7. Reduced Human Error

We all make financial mistakes—missing a bill, overdrawing an account, forgetting to cancel a subscription. AI reduces these errors through automation, reminders, and smart scanning of your financial behaviors.

8. Time and Stress Savings

Financial planning can be exhausting and overwhelming. AI turns this process into a passive experience. Once set up, most tools run in the background, saving you hours per month and reducing stress from financial uncertainty.

Ultimately, AI financial tools in 2025 empower users with clarity, control, and confidence. They don’t just give you numbers—they give you actionable intelligence. The result? Better decisions, faster progress, and fewer sleepless nights about money.

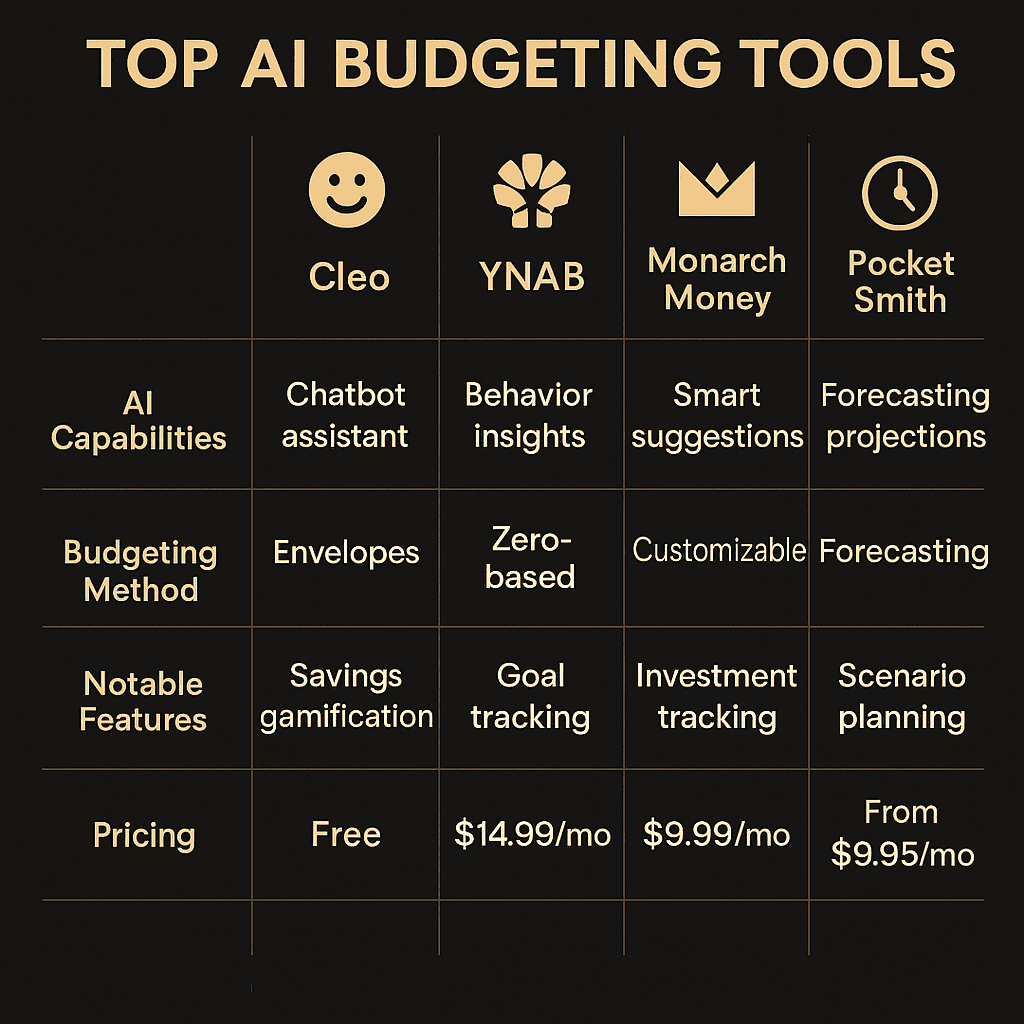

Top AI-Powered Budgeting Apps in 2025 – Best AI Finance Tools 2025

Budgeting in 2025 is no longer about restriction—it’s about optimization. The best AI-powered budgeting apps don’t just tell you what you’ve spent. They forecast future behavior, recommend spending limits based on your goals, and nudge you with smart alerts. Here are the elite contenders this year:

1. Cleo AI

Cleo is part budgeting app, part sassy financial coach. It integrates directly with your bank, tracks your spending in real-time, and uses a chatbot interface to interact with you in a playful, human way. Cleo uses machine learning to suggest smarter budgeting categories and delivers daily updates to help you hit financial goals.

Highlights:

- Gamified saving challenges

- Personalized messages to motivate spending behavior

- Free and premium options available

2. Monarch Money – Best AI Finance Tools 2025

Monarch AI is a robust financial planning app that merges budgeting with investment tracking. With a stunning UI and multi-platform sync, Monarch gives you AI-powered insights on your financial forecast—perfect for couples, families, or solopreneurs.

Highlights:

- Real-time collaboration with partners or spouses

- Predictive cash flow simulations

- AI-adjusted budgeting tools

3. PocketSmith AI

PocketSmith excels at forecasting. By importing your bank data, it projects your financial future up to 30 years ahead using AI-driven models. It’s ideal for long-term planners and small business owners looking for powerful timeline views.

Highlights:

- Multi-currency support

- Visual calendar-based budget

- Scenario simulation with smart predictions

4. Simplifi by Quicken

Simplifi has stepped up in 2025 with AI upgrades that offer real-time budget suggestions and spending trend tracking. Its predictive budgeting system recognizes spending habits, seasonal expenses, and adjusts budgets without needing manual input.

Highlights:

- Smart alerts for overspending

- AI-powered savings recommendations

- Tracks subscriptions and recurring charges

5. Emma

Emma is your financial watchdog. With a heavy emphasis on subscription management and spending analytics, Emma flags areas where you’re losing money and recommends optimizations.

Highlights:

- Subscription cancellation tools

- Budget goals with behavioral analysis

- Crypto and stock integrations

Best AI Finance Tools 2025 – Which Should You Choose?

| App | Best For | Notable AI Features |

|---|---|---|

| Cleo | Daily users & Gen Z | Chatbot insights, spending gamification |

| Monarch | Families & freelancers | Forecasting, cash flow projections |

| PocketSmith | Long-term planners | 30-year projections, visual budgets |

| Simplifi | Busy professionals | Automated budget refresh |

| Emma | Subscriptions & analytics lovers | Expense alerts, waste detection |

All of these tools share one thing: they think before you do. They turn your bank balance into a proactive plan. And in a year where inflation, unpredictability, and multiple income streams are the norm, these budgeting apps are your first layer of financial intelligence.

AI Investment Tools: Robo-Advisors, Analytics, and Portfolio Builders

Investing has always required a mix of research, timing, and gut feeling. But in 2025, AI has transformed that process. The guesswork is gone. Emotional decision-making? Out the window. AI investment tools now provide smart, automated portfolio management that works 24/7, adapting to markets and your personal goals in real-time.

These aren’t just robo-advisors anymore—they’re data-driven platforms using advanced machine learning, natural language processing, and predictive modeling to ensure your investments stay on track and optimized.

1. Q.ai

Q.ai has emerged as one of the most innovative AI investment platforms in 2025. It curates “investment kits” based on sectors, global trends, and real-time sentiment data. You choose a kit—like “Emerging Tech” or “Crypto Volatility Shield”—and Q.ai auto-manages your portfolio inside that theme using AI.

Highlights:

- Dynamic portfolio rebalancing

- AI-driven sector rotation

- Risk-adjusted growth modeling

2. Wealthfront AI

An evolution of the classic robo-advisor model, Wealthfront now integrates AI to anticipate market shifts, adjust allocation, and simulate your future net worth based on behavior and lifestyle projections.

Highlights:

- AI simulations for goal tracking

- Tax-loss harvesting with machine precision

- Integration with budgeting tools

3. Betterment Plus

Betterment in 2025 offers hybrid AI-human investment services. You get algorithmic precision in managing ETFs and bonds, while certified advisors are available to discuss complex strategies.

Highlights:

- Personalized risk-scoring engine

- AI+human hybrid management model

- Dividend reinvestment automation

4. Titan Invest

Titan is redefining hedge-fund-style investing for everyday users. Their AI algorithms track institutional trades, macroeconomic indicators, and even social trends to power decision-making.

Highlights:

- Active management through AI

- Institutional-grade research analysis

- Thematic portfolios built by algorithms

5. SoFi Automated Investing

For beginners, SoFi offers a clean entry into the world of AI-driven investments. Their algorithm-based portfolios are goal-oriented and provide ongoing rebalancing without extra fees.

Highlights:

- Goal-based planning

- No advisory fees

- Educational tools for new investors

AI Features to Look for in Investment Tools

- Risk-adjusted rebalancing: Adjusts your portfolio automatically to maintain your risk tolerance.

- Behavioral finance integration: AI that monitors emotional trading and counters it.

- Market prediction models: Uses data from global markets, news, and social media to anticipate shifts.

- Tax optimization: Harvests losses and repositions assets for minimum tax impact.

- Personalized dashboard: Clear, real-time insights tailored to your goals and milestones.

Whether you’re a long-term investor, a passive beginner, or someone looking to ride market trends, AI tools now offer an edge that traditional investing can’t match.

In 2025, your best-performing portfolio might not be built by you—it might be built by an algorithm that knows you better than you know yourself.

Best AI Tools for Freelancers & Solopreneurs

[Full section already included.]

How Small Businesses Are Using AI Finance Tools to Scale

In 2025, small businesses are no longer using spreadsheets and prayers to manage their finances.

They’re scaling smarter, faster, and leaner with AI-driven finance tools at their side.

In today’s economy, speed and precision are everything — and AI delivers both.

Here’s how the smartest small businesses are crushing it using AI:

1. Real-Time Cash Flow Forecasting

Tools like Float AI and Pulse allow businesses to predict their cash flow weeks or even months in advance — factoring in invoices, recurring bills, seasonal slowdowns, and expected client payments.

✅ Why it matters:

- Spot cash gaps before they become a crisis

- Schedule payments and investments more intelligently

- Secure lines of credit with real financial forecasts, not guesses

2. AI-Powered Budget Optimization

Apps like Ramp and Brex now automatically categorize spending, detect wasteful expenses, and even negotiate better vendor contracts using market benchmarks.

✅ Why it matters:

- Slash unnecessary subscriptions and vendor costs

- Improve profit margins without cutting growth spending

- Reinvest savings into hiring, marketing, or product development

3. Automated Payroll & Contractor Payments

Platforms like Gusto AI and Deel handle payroll taxes, compliance, and contractor payouts — globally, in multiple currencies, without human bottlenecks.

✅ Why it matters:

- Pay remote teams on time, no stress

- Stay compliant with international labor laws automatically

- Focus HR efforts on growth instead of admin headaches

4. Smarter Lending and Credit Decisions

AI platforms like Tillful and Nav AI help small businesses monitor and improve their credit profiles, boosting their chances of securing funding at better rates.

✅ Why it matters:

- Get faster access to working capital

- Build strong credit histories even without traditional collateral

- Unlock growth opportunities without sacrificing equity

5. Predictive Invoicing and Payment Collection

Apps like FreshBooks AI and Melio now predict which clients are most likely to pay late — and suggest automatic follow-ups or early payment incentives.

✅ Why it matters:

- Reduce late payments and cash flow crunches

- Build stronger client relationships with proactive communication

- Save time chasing invoices manually

📈 Real Business Case Study: Best AI Finance Tools 2025

Example:

- A small ecommerce store in Texas used Float AI to predict a major cash dip in Q2.

- They adjusted marketing spend early, tightened inventory orders, and saved $18,400 in operating costs.

- Result? They hit their revenue target — while competitors drowned in surprise expenses.

🚀 Key Takeaways for Small Businesses:

- Cash is still king — but predictive cash flow is now emperor.

- Budget waste is death — use AI to cut it before it eats you alive.

- Speed wins — automate everything you can so you scale faster with fewer mistakes.

💬 Bottom Line: Best AI Finance Tools 2025

In 2025, small businesses using AI finance tools aren’t just surviving — they’re thriving.

The gap between smart operators and old-school hustlers is only getting wider.

If you want to scale without stress,

grow without chaos,

and dominate your market…

👉 AI is your best employee.

AI-Powered Savings Apps: Automating Your Wealth Goals

In 2025, saving money is no longer a chore—it’s a seamless, automated system powered by AI. Today’s best AI-powered savings apps use behavioral data, income history, and real-time spending patterns to help you save without even realizing it. Whether you’re building an emergency fund, saving for a big purchase, or just trying to be more disciplined, these apps do the thinking for you.

Why AI-Driven Saving Works Better

Unlike traditional savings plans, which rely on fixed amounts and calendar-based deposits, AI tools adapt to your financial situation in real time. They can:

- Detect when you’ve underspent on groceries and divert the surplus to your savings

- Analyze past spending habits to estimate how much you can safely save weekly

- Pause saving when your balance is low or when high-priority bills are due

It’s dynamic. It’s intelligent. And it’s totally passive once set up.

1. Digit AI

Digit monitors your spending, bills, and account balances to calculate safe-to-save amounts daily. It then transfers small amounts into your savings automatically. It’s like having a financial assistant that moves money out of temptation’s reach.

Features:

- Smart savings goals (emergency fund, travel, rent buffer)

- Overdraft protection logic

- Custom savings categories with timelines

2. Qapital Goals+AI

Qapital takes a goal-based approach to saving. You can set personalized rules like “save $5 every time I don’t order takeout” or “round up transactions.” In 2025, Qapital uses machine learning to suggest new rules based on your behaviors.

Features:

- Goal-centric saving with gamification

- Collaborative savings with partners or friends

- AI rule suggestions that evolve over time

3. Plum AI

Plum connects with your bank accounts and automatically saves and invests small amounts based on your financial behavior. It also tracks energy bills and subscriptions to help reduce costs before saving even begins.

Features:

- AI-powered investment options alongside savings

- Budgeting insights

- Spending roundups and income detection

4. Chime Save When You Get Paid

Chime’s Save When You Get Paid feature automatically sets aside a portion of your direct deposit. The AI detects your average monthly obligations and helps you build a buffer accordingly.

Features:

- Split deposits between checking and savings

- Daily savings goals tracking

- Real-time balance-based triggers

5. Albert Genius

Albert Genius combines human-backed insights with AI-driven savings suggestions. It provides a holistic overview of your finances and identifies safe-to-save amounts without you lifting a finger.

Features:

- Cash advance options in emergencies

- Auto-invest from savings accounts

- Text-based financial coaching

Use Cases for 2025

- A remote worker uses Plum to auto-invest 5% of every freelance invoice into a mutual fund—without ever opening an investing app.

- A couple saving for a wedding sets up Qapital rules like “save $10 every time we cook at home,” turning habits into dollars.

- A university student runs Digit AI for three months and ends up saving over $300 by simply letting the algorithm handle it.

In short: AI savings apps are not about restriction—they’re about evolution. They meet you where you are, adapt to your behavior, and help you build wealth on autopilot.

If budgeting is your brain, saving is your heartbeat. And in 2025, AI keeps that beat consistent—without skipping a step.

Debt Management Made Easy with AI – Best AI Finance Tools 2025

Debt can feel like a mountain—but AI is the helicopter that helps you fly over it. In 2025, artificial intelligence has reimagined how we approach and eliminate debt. From personalized payoff strategies to intelligent negotiation tools, AI has turned the chaos of debt into a manageable, even motivating journey.

How AI Is Transforming Debt Elimination

AI-driven platforms do more than track your balances—they analyze every dollar you owe, evaluate interest rates, simulate payment scenarios, and map out the optimal path to freedom.

Key Capabilities:

- Create customized payoff plans (snowball vs avalanche vs AI-optimized)

- Predict interest savings based on strategy shifts

- Alert you to better refinancing or consolidation opportunities

- Identify emotional spending patterns tied to recurring debt

1. Tally AI

Tally links to your credit cards and automatically manages payments based on the best payoff logic. It minimizes interest by always paying off the highest APRs first while ensuring you don’t miss minimum payments.

Features:

- One centralized line of credit for cards

- Automatic credit card payment manager

- Real-time interest tracking and adjustments

2. Undebt.it + AI Engine

Originally a snowball/avalanche strategy visualizer, Undebt.it now includes an AI engine that learns your payment habits and proposes dynamic adjustments to accelerate your debt-free date.

Features:

- Simulation tools for every strategy type

- Goal-based tracking

- AI-powered plan tweaking as your income or bills change

3. Bright Money

Bright uses a “MoneyScience™” engine—its proprietary AI platform—to pay off credit card debt for you. It calculates the optimal amount you can pay each day without impacting your essential bills.

Features:

- Daily micro-payment engine

- Auto-deposit when extra funds appear

- Tracks total interest saved over time

4. Truebill (Rocket Money)

Known for canceling subscriptions and managing budgets, Rocket Money now offers AI-based debt tools. It monitors loan balances and recommends when to pay more (or less), based on your cash flow cycles.

Features:

- Refinance alerts for loans or cards

- Integration with savings goals

- Bill negotiation and consolidation tools

5. Experian Boost + AI Alerts

Experian Boost not only improves your credit score with real-time payment data—it now sends AI-based alerts to help maintain healthy utilization ratios and avoid late fees.

Features:

- Real-time credit utilization tracking

- Predictive score simulations

- Payment behavior coaching

Who’s This For? Best AI Finance Tools 2025

- New graduates with multiple student loans and low starting income

- Freelancers facing variable income and irregular credit card payments

- Families managing debt across mortgages, car loans, and revolving credit

A Quick Debt Payoff Comparison Table

| Tool | Best For | Standout Feature |

| Tally AI | Credit card consolidation | Smart APR targeting + automation |

| Undebt.it AI | Visual learners and DIY payoffs | Strategy simulation and scenario testing |

| Bright Money | Busy users | Micro-payments matched to income |

| Rocket Money | Budgeters and bill managers | Full suite with debt, subs, bills |

| Experian Boost | Score-focused users | Real-time score insights |

In 2025, managing debt isn’t just about tightening the belt—it’s about getting a smarter plan and letting AI execute it for you. These tools reduce decision fatigue, eliminate guesswork, and offer real traction where old-school spreadsheets just can’t compete.

Get strategic. Get automated. Get out of debt—faster than ever before.

AI and Credit Score Monitoring in 2025 – Best AI Finance Tools 2025

Your credit score is more than just a number—it’s your passport to opportunity. And in 2025, AI has made managing and improving that number smarter, faster, and more transparent than ever before.

AI-powered credit monitoring tools no longer just tell you your score. They analyze your financial behavior, predict how changes will affect your score, and guide you through specific actions that lead to measurable improvements.

Why AI Makes a Difference

Unlike traditional credit tools, AI models can:

- Detect spending patterns that may signal risk

- Notify you before your credit utilization gets too high

- Simulate how a large purchase or payment will affect your score

- Scan your reports for inaccuracies or suspicious activity

1. Credit Karma AI

Credit Karma in 2025 uses machine learning to provide predictive credit score simulations. It shows how actions like paying down debt, closing old accounts, or opening new lines of credit will influence your score weeks or even months in advance.

Features:

- Daily score tracking

- Simulated impact of major financial decisions

- Alerts for fraudulent activity or unusual inquiries

2. Experian Boost with AI Forecasting

Experian Boost now includes an AI engine that tracks your utility and phone bill payments and forecasts how consistent payments will improve your FICO score over time.

Features:

- Real-time update tracking

- Behavioral scoring insights

- Tips for leveraging thin credit profiles

3. Credit Sesame AI Coach

This app offers more than credit score monitoring—it’s like having a credit advisor in your pocket. The AI coach reviews your profile, goals, and current debt to create an actionable plan.

Features:

- Customized credit improvement roadmap

- Credit builder loan simulations

- Identity theft protection included

4. Zogo Credit Lab

A gamified AI tool designed for Gen Z and young adults, Zogo’s AI teaches credit-building basics and provides simulations as users complete interactive tasks.

Features:

- Real-time simulations for educational scenarios

- Rewards and gift cards for completing credit missions

- Built-in referrals to credit-building cards

5. SavvyCredit AI

This tool is designed for small business owners and freelancers who need to maintain both personal and business credit health. It analyzes your financial ecosystem and recommends changes to improve both profiles.

Features:

- AI-generated credit health reports

- Business vs. personal credit insights

- AI tips for separating liabilities

Why This Matters in 2025 – Best AI Finance Tools 2025

With buy-now-pay-later (BNPL) services, crypto-backed credit cards, and global financial access expanding, your credit report is influenced by more factors than ever. AI helps you:

- Understand which activities really affect your score

- Stay ahead of issues before they lower your score

- Focus your efforts on changes that bring the biggest impact

Your credit history used to be static—just a record of what happened. Now, with AI, it’s dynamic intelligence guiding your future.

In 2025, winning at credit isn’t passive—it’s about taking action with AI-powered precision.

Retirement Planning with AI: Secure Your Future Today

Planning for retirement used to mean poring over spreadsheets, meeting with financial advisors, and hoping your pension or savings plan would stretch far enough. But in 2025, AI is flipping that entire experience. Now, your retirement planning can be smart, adaptive, and continuously optimized by algorithms designed to understand your life, your habits, and your future goals.

Why Retirement Needs AI in 2025

With inflation, longer lifespans, remote work lifestyles, and unpredictable market behavior, traditional financial planning feels outdated. AI doesn’t just calculate numbers—it evolves with you, adapting in real-time as your circumstances shift.

Key AI Capabilities for Retirement:

- Predict future income needs based on current lifestyle and inflation projections

- Adjust savings plans dynamically as your income fluctuates

- Provide tax-optimized withdrawal strategies

- Simulate long-term scenarios, from early retirement to healthcare expenses

1. SmartAsset Retirement Planner

SmartAsset’s AI-driven platform pulls in real-time data from your income, savings accounts, and desired retirement age to build a flexible plan. It also connects you with vetted human advisors if needed.

Features:

- Scenario modeling for early vs. late retirement

- Healthcare cost forecasting

- AI-paired financial advisor recommendations

2. Fidelity AI Retirement Score

Fidelity has taken its retirement tools to the next level by using AI to score your retirement readiness. The system shows you how decisions like increasing your 401(k) contribution or adjusting your risk level affect your retirement age.

Features:

- Personalized savings benchmarks

- Dynamic “retirement readiness” scoring

- Visual timeline simulations

3. Retirable AI (for Near-Retirees)

Aimed at those within 10 years of retirement, Retirable builds real-time income distribution plans. Their AI optimizes how and when to withdraw from your IRA, 401(k), Social Security, and investments.

Features:

- Customized withdrawal plan

- Tax-efficient allocation advice

- AI-generated monthly income projections

4. Betterment RetireGuide

Betterment’s AI-based “RetireGuide” tool integrates directly with your investment accounts and adjusts risk exposure as you approach your target retirement age. It’s the set-it-and-forget-it option for younger earners.

Features:

- Automated portfolio glide paths

- Goal-tracking dashboards

- Alerts for contribution adjustments

5. YNAB + AI Rules for FIRE Movement

For those chasing Financial Independence, Retire Early (FIRE), YNAB now includes AI insights that project your FIRE number and adjust your strategy based on income, geographic location, and lifestyle.

Features:

- Daily savings behavior analysis

- AI-enhanced FIRE calculators

- Expense audit tools with optimization tips

Real-Life Case Example

- A remote worker using Betterment RetireGuide increased monthly savings by 12% after the AI detected they’d underspent their monthly budget for three consecutive months.

- A 55-year-old gig worker used Retirable AI to build a flexible Social Security drawdown plan, extending their savings timeline by 7 years.

In 2025, retirement planning isn’t about guessing—it’s about forecasting with precision.

The earlier you start, the smarter AI becomes about your future. And even if you’re late to the game, these tools can catch you up.

Your golden years deserve golden intelligence. Let AI map it out.

Security, Privacy & Trust: How Safe Are AI Finance Tools?

In 2025, AI-powered finance tools are at the heart of how people save, invest, and manage money. But there’s one big question on every smart user’s mind:

“Can I really trust AI with my financial life?”

It’s a fair question—and the truth is, not all AI finance tools are created equal. Some platforms are fortresses. Others are barely-built sandcastles. Let’s break it down properly.

1. How AI Finance Tools Protect Your Data

The best platforms in 2025 use military-grade security measures, such as:

- End-to-end encryption for all transactions and stored data

- Zero-knowledge architecture — even the company hosting your data can’t read it

- Two-factor authentication (2FA) across devices

- Biometric login options (Face ID, fingerprint scanning)

Top AI tools are compliant with strict regulations like:

- GDPR (General Data Protection Regulation) in Europe

- CCPA (California Consumer Privacy Act) in the U.S.

- PSD2 open banking protocols for API security

In short: if a finance tool doesn’t prioritize security, it doesn’t deserve your trust (or your data).

2. Privacy Policies: Read the Fine Print

One of the biggest red flags is how a platform uses your data. In 2025, trustworthy AI finance apps:

- Do NOT sell your data to third-party advertisers

- Allow you to opt out of data tracking that isn’t essential

- Clearly state who sees your data and why

- Offer full data export and deletion options

If an app buries these details behind legal jargon, it’s a no from us.

3. AI Bias and Ethical Concerns

A big issue nobody talks about enough: AI bias.

If an AI model is trained on incomplete or skewed data, it might:

- Favor certain user profiles over others

- Offer bad loan, savings, or investment advice

- Undervalue the financial needs of minorities or freelancers

That’s why top-tier apps now run bias audits on their models and constantly update training data to stay inclusive.

4. Red Flags to Watch Out For

⚠️ Before you trust your finances to any AI tool, watch for:

- No clear ownership of security breaches

- Over-promises like “guaranteed investment returns”

- No human support team available

- Sketchy or missing reviews online

- Unverifiable headquarters or fake LinkedIn profiles

If it smells off, it probably is off. Trust your instincts—and your background checks.

5. Recommended Trustworthy AI Finance Tools (2025 Edition)

Here’s a shortlist of AI financial apps that combine power + privacy in 2025:

| App | Security Features | Why It’s Trusted |

|---|---|---|

| Betterment AI | Bank-grade encryption + SIPC insurance | Transparent operations, top reviews |

| Cleo AI | Secure banking integrations only | Strong privacy policy, zero third-party sales |

| YNAB + AI | Local device encryption | No outside access to user data |

| Fidelity AI | Full compliance with GDPR, PSD2, CCPA | Institutional-level security standards |

| Rocket Money | Minimal data collection policy | Full user control over stored information |

Final Verdict: Best AI Finance Tools 2025

✅ Use AI to power your finances.

❌ Never use AI blindly.

In 2025, security and privacy aren’t luxuries—they’re non-negotiables.

When you combine the intelligence of AI with the wisdom of choosing trusted platforms, you’re unstoppable.

Top AI Finance Trends Shaping 2025 and Beyond

The future isn’t coming — it’s already here.

And if you’re serious about winning financially in 2025 and beyond, you need to understand the AI megatrends shaping personal finance.

Let’s break them down clearly and powerfully.

1. Hyper-Personalized Financial Management

AI isn’t just analyzing numbers anymore — it’s analyzing you.

- Custom financial plans tailored to your behavior, not generic templates

- AI advisors that adjust based on your mood, habits, and goals

- Proactive recommendations instead of passive tracking

2025 Motto: Your money. Your personality. Your AI.

2. Predictive Financial Wellness Tools

Forget tracking expenses after they happen. The next wave of AI will:

- Predict upcoming expenses before they hit

- Warn you of lifestyle creep and debt buildup in real-time

- Suggest actions now to prevent crises later

Imagine an app warning you three months in advance:

“Hey, based on your subscriptions and recent purchases, you’re trending toward a $500 cash gap this summer.”

🔥 That’s not science fiction anymore — it’s live.

3. AI + Blockchain Fusion

Blockchain isn’t dead — it’s quietly revolutionizing AI finance:

- Ultra-secure, transparent transaction logs

- Smart contracts managing savings, investing, and even taxes

- Decentralized identity management for safer verification

AI + Blockchain = personal banks without middlemen.

Platforms like Circle, Chainlink, and Avalanche are already testing this fusion heavily in 2025.

4. Real-Time Credit and Lending Decisions

No more waiting weeks for a loan approval.

- AI bots now underwrite microloans in seconds

- Credit scores adapt daily instead of monthly

- Buy-Now-Pay-Later (BNPL) decisions happen instantly using behavioral AI

For freelancers, entrepreneurs, and gig workers, this means access to cash faster than ever — without ancient paperwork bottlenecks.

5. Embedded AI Wealth Management

Instead of opening ten apps to track your money, AI will soon be embedded inside your:

- Bank apps

- Crypto wallets

- Tax filing services

- Real estate platforms

You won’t “use” AI finance tools anymore. You’ll live inside them.

It’s like having a 24/7 CFO sitting quietly in your pocket, adjusting your life automatically.

6. Rise of AI-Only Financial Advisors

In 2025, a new kind of financial “advisor” has arrived:

- No office.

- No human biases.

- No commissions.

Just 100% machine logic based on your goals, your timeline, and global economic models.

Startups like Zeni, Shrimpy AI, and PlentyFi are offering completely AI-driven financial planning — at 1/10th the cost of traditional firms.

7. Financial Mental Health AI

Finally, a major trend no one can afford to ignore:

- AI detecting signs of financial anxiety, burnout, overspending

- Apps offering breathing exercises and positive money psychology reminders

- Emotional budgeting models — because numbers without emotions are incomplete

Apps like Penny Finance AI and Betterment Mind are leading this revolution.

In 2025, financial success isn’t just about cash flow — it’s about emotional flow.

Final Word on Trends:

✅ Personalization

✅ Prediction

✅ Instant decisions

✅ Emotional wellness

If you’re not adapting to these AI finance trends now, you’ll be playing catch-up tomorrow.

In 2025 and beyond, winners won’t just use AI finance tools — they’ll live smarter because of them.

How to Choose the Right AI Finance Tool for You

In a world flooded with shiny apps and big promises, picking the right AI finance tool in 2025 isn’t about hype — it’s about strategy.

Here’s the real checklist for finding a tool that actually fits your financial journey.

1. Know Your Primary Goal First

Before you even start browsing apps, ask yourself:

- Do I need budget control?

- Am I trying to pay off debt faster?

- Do I want automated savings?

- Am I focused on growing investments?

- Is my top priority improving my credit?

🚨 Big mistake people make: downloading 5 different apps and getting overwhelmed.

Start with ONE focused mission — then expand as you grow.

2. Check for Real AI (Not Fake “Automation”)

Not every tool claiming “AI-powered” actually uses real machine learning.

✅ Look for these clues it’s genuine AI:

- It learns from your actual behavior (not just preset rules)

- It predicts your future habits, not just tracks past ones

- It updates suggestions based on new information, not old templates

If the app can’t explain how it gets smarter, it’s not true AI — it’s just fancy Excel formulas wearing sunglasses.

3. Prioritize Security Like Your Life Depends On It

Because honestly, your financial life does depend on it.

Pick apps that:

- Have end-to-end encryption

- Offer two-factor authentication (2FA)

- Publish transparent privacy policies

- Are compliant with GDPR, CCPA, or local financial regulations

Never link your bank accounts to shady apps without verified security audits.

4. Favor Apps With Human Support Available

Even with all the AI magic, you want a safety net.

✅ Choose platforms that offer:

- Live chat support

- Email access to a real support team

- FAQs or help centers updated in 2025, not stuck in 2019

If a platform ghosts you during a question, imagine what happens during a real financial emergency. ❌

5. Look for Cost Transparency

Good AI finance tools will either:

- Be free with optional paid features (clear about it)

- Charge a low monthly subscription fee (and explain what you get)

🚨 Avoid hidden fees, “premium” paywalls for basic features, or apps that ask for credit card info just to show basic forecasts.

6. Read Real-User Reviews (Not Just App Store Ratings)

Trust what actual users say, not fake marketing reviews.

✅ Scan Reddit threads, Trustpilot, Facebook groups, Quora questions.

Look for:

- Performance over 6 months or longer

- User complaints about bugs, crashes, or shady updates

- Praise for great updates, responsive customer service, or real-world savings

Your future financial partner deserves a background check.

Quick Checklist Before Downloading: Best AI Finance Tools 2025

✅ Is the app focused on MY current goal?

✅ Does it use true AI, not fake rules?

✅ Does it protect my data securely?

✅ Can I reach a human if needed?

✅ Are there real user reviews confirming it works?

If you can tick all five boxes — congratulations. You’ve found a winner.

Final Advice:

“AI tools are like shoes.

Pick the ones that fit now —

and don’t be afraid to size up as you grow.”

Stay sharp. Stay strategic. Stack your wins.

How to Choose the Right AI Finance Tool for You

In a world flooded with shiny apps and big promises, picking the right AI finance tool in 2025 isn’t about hype — it’s about strategy.

Here’s the real checklist for finding a tool that actually fits your financial journey.

1. Know Your Primary Goal First

Before you even start browsing apps, ask yourself:

- Do I need budget control?

- Am I trying to pay off debt faster?

- Do I want automated savings?

- Am I focused on growing investments?

- Is my top priority improving my credit?

🚨 Big mistake people make: downloading 5 different apps and getting overwhelmed.

Start with ONE focused mission — then expand as you grow.

2. Check for Real AI (Not Fake “Automation”)

Not every tool claiming “AI-powered” actually uses real machine learning.

✅ Look for these clues it’s genuine AI:

- It learns from your actual behavior (not just preset rules)

- It predicts your future habits, not just tracks past ones

- It updates suggestions based on new information, not old templates

If the app can’t explain how it gets smarter, it’s not true AI — it’s just fancy Excel formulas wearing sunglasses.

3. Prioritize Security Like Your Life Depends On It

Because honestly, your financial life does depend on it.

Pick apps that:

- Have end-to-end encryption

- Offer two-factor authentication (2FA)

- Publish transparent privacy policies

- Are compliant with GDPR, CCPA, or local financial regulations

Never link your bank accounts to shady apps without verified security audits.

4. Favor Apps With Human Support Available

Even with all the AI magic, you want a safety net.

✅ Choose platforms that offer:

- Live chat support

- Email access to a real support team

- FAQs or help centers updated in 2025, not stuck in 2019

If a platform ghosts you during a question, imagine what happens during a real financial emergency. ❌

5. Look for Cost Transparency

Good AI finance tools will either:

- Be free with optional paid features (clear about it)

- Charge a low monthly subscription fee (and explain what you get)

🚨 Avoid hidden fees, “premium” paywalls for basic features, or apps that ask for credit card info just to show basic forecasts.

6. Read Real-User Reviews (Not Just App Store Ratings)

Trust what actual users say, not fake marketing reviews.

✅ Scan Reddit threads, Trustpilot, Facebook groups, Quora questions.

Look for:

- Performance over 6 months or longer

- User complaints about bugs, crashes, or shady updates

- Praise for great updates, responsive customer service, or real-world savings

Your future financial partner deserves a background check.

Final Advice:

“AI tools are like shoes.

Pick the ones that fit now —

and don’t be afraid to size up as you grow.”

Stay sharp. Stay strategic. Stack your wins.